Trapshooter1

Well-Known Member

Hollow Timber River bottoms are bring 4-5k.

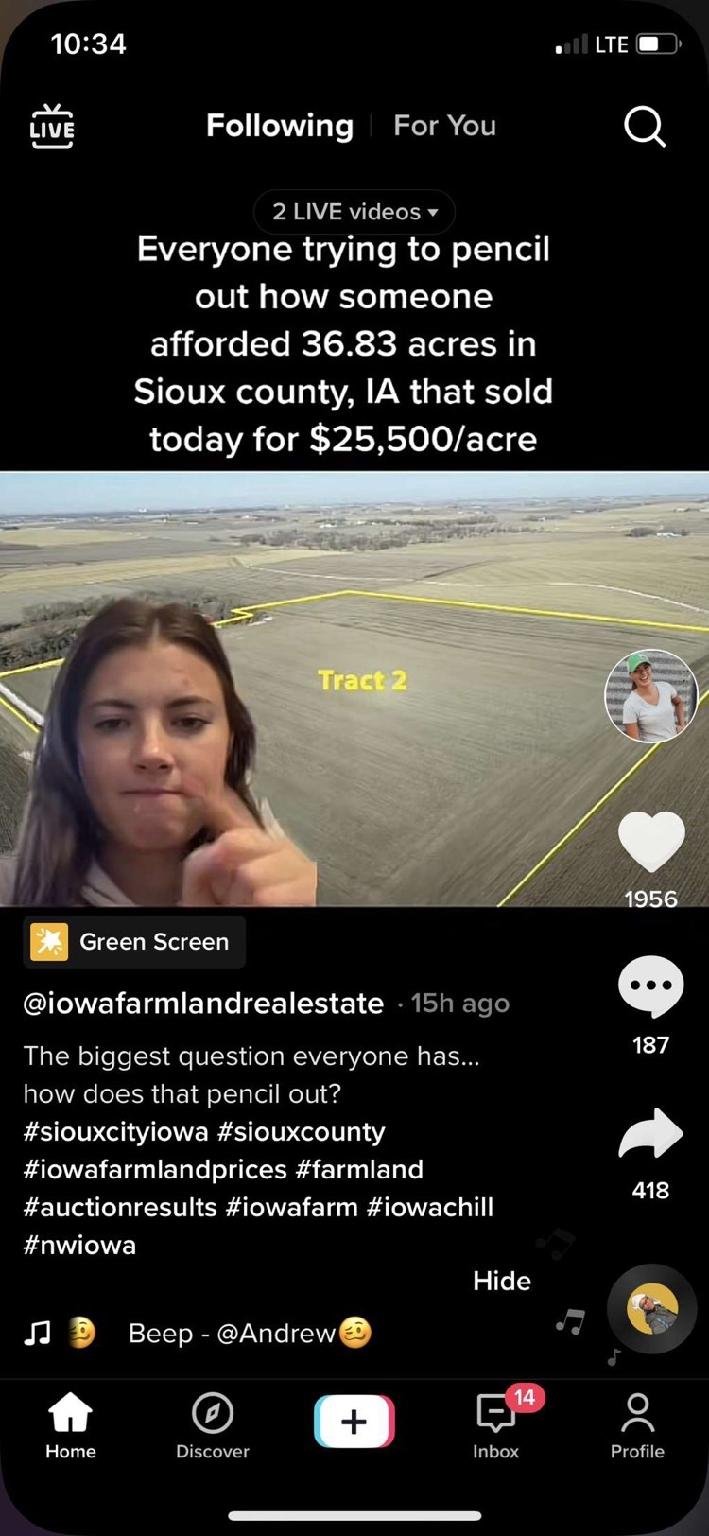

Deep black Farmland is bringing 17-25k(Recent Sioux County land auction)

And floody 55 CSR low land is being sold for 9-10k.

Where do people draw the line????

I honestly think the real estate market is on the brink of collapse. I'd say within 1 years we re in for a helluva reset.

Deep black Farmland is bringing 17-25k(Recent Sioux County land auction)

And floody 55 CSR low land is being sold for 9-10k.

Where do people draw the line????

I honestly think the real estate market is on the brink of collapse. I'd say within 1 years we re in for a helluva reset.