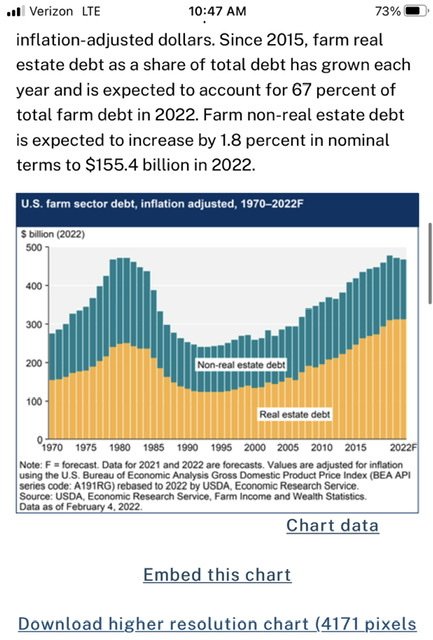

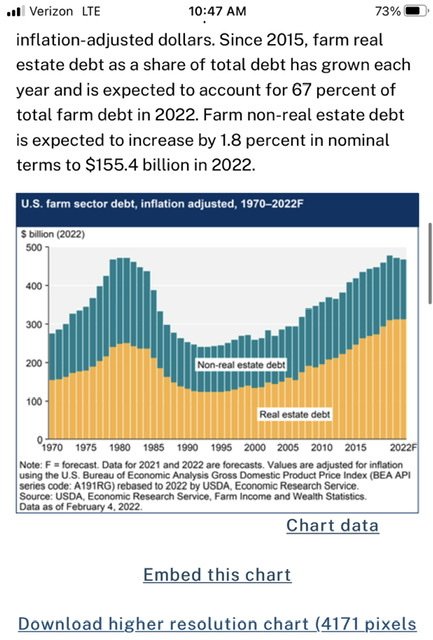

I’m not saying what will happen to market BUT…. To add to mid 80’s analogy which we mirror….. DEBT is also increasing. Almost at same place as 80’s. So- we have same/similar: debt, high commodity prices, high inflation, rising interest rates & sky rocketing input costs. It’s actually spooky how similar it is. “Low Debt” was the one difference folks usually claim but actually not totally right. SEE BELOW.

Not predicting anything but folks should think through this. I knew a lot of farmers who didn’t make it from the 2017-2019 market when ag prices softened a lot…. Smart & hard working folks held on like always but newer farmers or any sloppy farmer felt it big time: bankrupt or new career (typical for cycles in markets). This was…

Without high inputs & with low interest & lower land prices.

This scenario today could have some major changes coming. Maybe, maybe not.

Read this LINK. Smart & hard working usually make it during tough times BUT- those that don’t understand history are bound to repeat it.

www.ers.usda.gov

www.ers.usda.gov

Not predicting anything but folks should think through this. I knew a lot of farmers who didn’t make it from the 2017-2019 market when ag prices softened a lot…. Smart & hard working folks held on like always but newer farmers or any sloppy farmer felt it big time: bankrupt or new career (typical for cycles in markets). This was…

Without high inputs & with low interest & lower land prices.

This scenario today could have some major changes coming. Maybe, maybe not.

Read this LINK. Smart & hard working usually make it during tough times BUT- those that don’t understand history are bound to repeat it.

USDA ERS - Assets, Debt, and Wealth

The farm business balance sheet reports estimates of the current market value of farm business sector assets, debt, and equity as of December 31 of a given year. It is called a "balance sheet" because of the accounting relationship: assets – debt = farm equity. Farmers and ranchers...

Last edited: