Hardwood11

It is going to be a good fall!

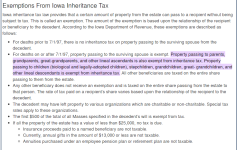

A lot of gold & silver transfers from generation to generation and is not taxed.Another thing with gold..

How are gains on gold taxed?

Gold is subject to a 28% long term capital gains tax rate by the IRS.

Safes are private and who’s keeping track? I’m a fan of gold and silver but only at say 1-5% of your total portfolio.