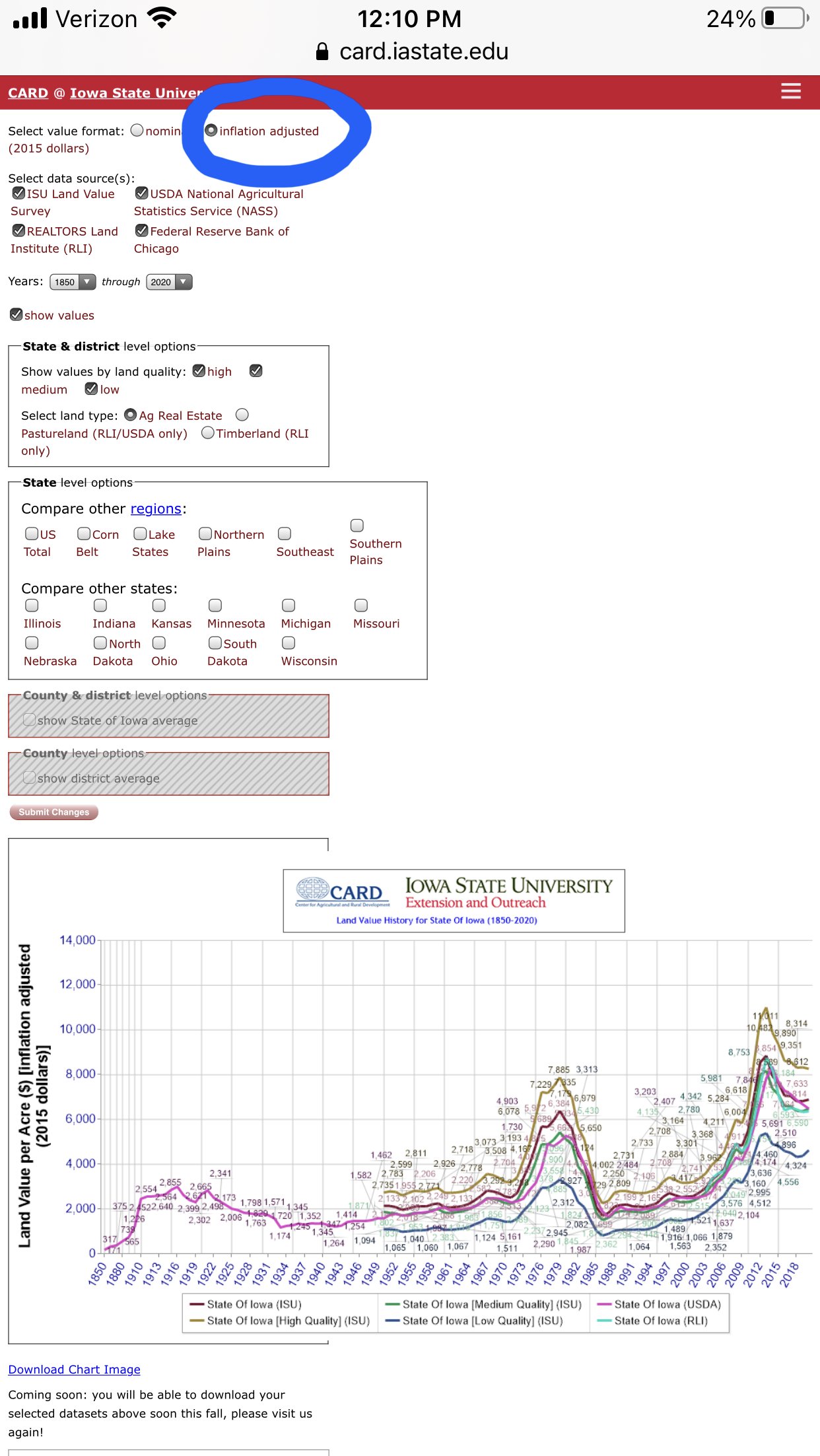

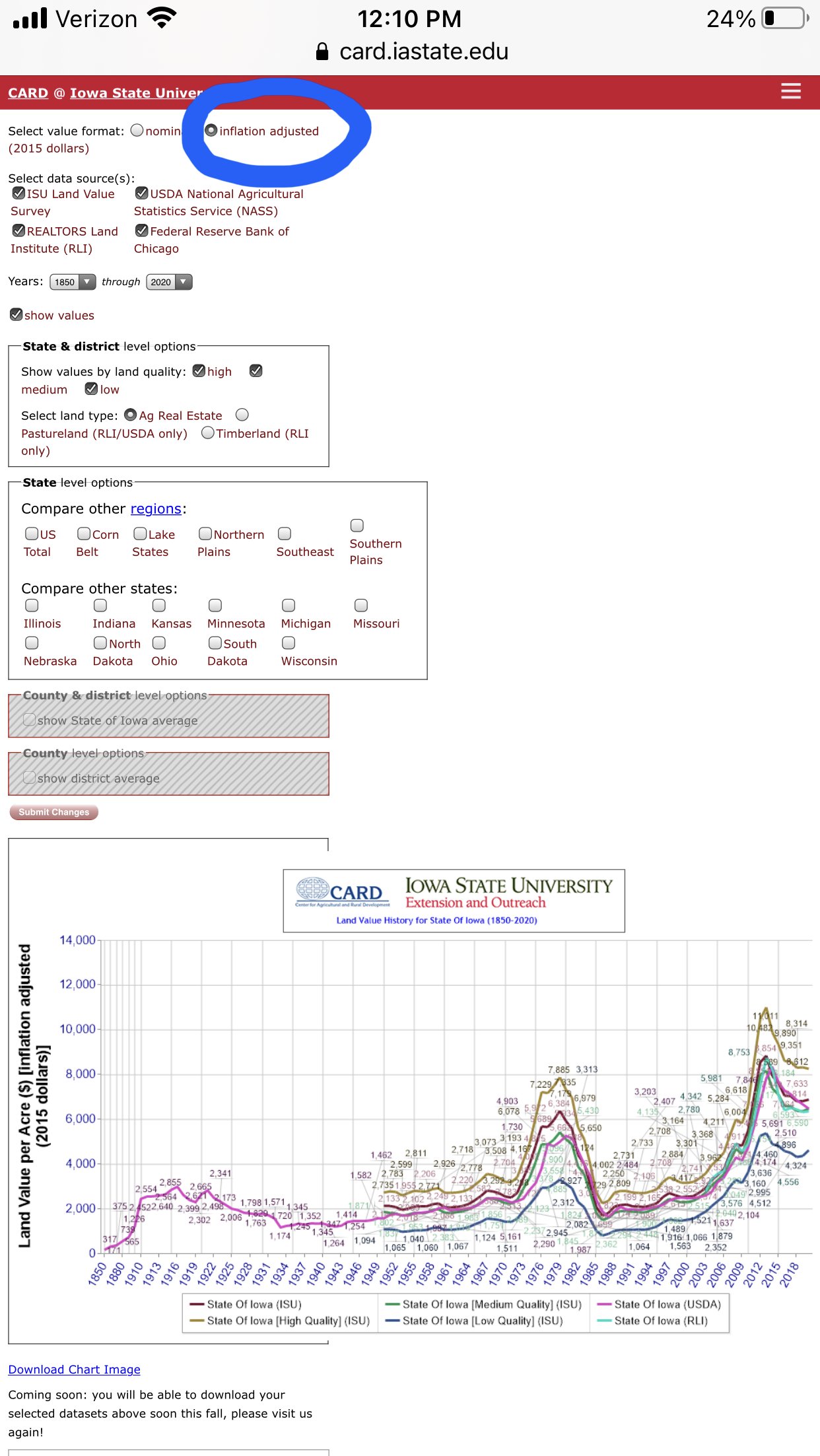

Another interesting thing to ponder- just came to mind...

BOOM times... last 4 years.... ag ground has actually came down. Same with boom times after WWII- stayed flat. *possibly due to rising interest rates & strong dollar (harder on exports when dollar strong)

Major recessions of 2008 & 2001- ag land prices went up while most of economy cratered. Great Depression, again, lower but stable & didn’t crash like the economy did. *maybe due to lowering of interest rates.... 2001 recession would for sure have seen a weaker dollar which is good for exports.

Land crashed the worst in 80’s of course. Insanely high interest rates, high debt burdens & a fall off of high commodity prices.

Interest rates being high or low played role in lot of this. Same with value of the US dollar. I would say this is also followed to a lesser extent by: government subsidies, investors wanting out of stock market, export market, etc.

it’s an interesting market if one gets into studying it. Land market for sure isn’t for everyone. Many might make the case the stock market is historically better. Which if u only base it upon % increase in value over time- would be correct. More to it than that though.

. In this environment we are in TODAY - dang would it make me nervous being all in on stocks. Comfortable on farm land even though it’s higher right now. No right or wrong answer - just interesting. Impossible to predict the future as well. Still go back to the old saying for anything “be cautious when others are greedy. Be greedy when others are cautious”.

www.card.iastate.edu

www.card.iastate.edu