Well here we go... maybe. Ever dream to think Russia would impact prices of ground in Iowa? Well its quite possible. Stock market doesn't seem to like it a bit. Nor energy prices. So if this keeps escalating things could spiral down further. That'll certainly affect rec ground prices at a min.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Land prices / insane!!!

- Thread starter Wi transplant

- Start date

-

- Tags

- None

Tmayer13

Well-Known Member

I know exactly where these farms are located. I know the farmers that sold the land as they are my customers. Definitely not rec ground and they paid a pretty penny for it!I am seeing more titling like this around me. For higher end ag ground. Clearly not for “hunting land”.

View attachment 122084View attachment 122085View attachment 122086

No doubt the out of state investments have been ramping up tillable ground much harder in last 12-18 months. There’s a limited supply of high end dirt …. When inflation hits, other investments aren’t ideal…. Many look to higher end tillable as a “safe bet”. Are they paying “too much” ? Sure. Does it matter to them? NOPE. Even if values cut in half- they don’t care. A lot of investment $ has hit the Midwest ag market…. A lot of other “big names” that put it in an LLC, Corp, trust, etc where u don’t realize who it is. It doesn’t mean these prices will stay high or these folks won’t lose on shorter term values BUT it does speak to the uniqueness & likely, safety, of long term investing in high end ag ground.

On other hand…. The “counter argument” to high end ag ground…. 1) With hybrids making leaps & bounds by the decade- we can grow more on marginal ground. Possibly increasing supply to the point where it puts down pressure on high end ag land prices. 2) “they aren’t making any more of it” - is not quite true unfortunately…. As humans doze out countless thousands or millions of acres of places like Brazilian rain forest- we are rapidly expanding the agricultural areas. Even the dozing you see in the Midwest when grain spikes- astounding. There will be some problems from it…. Droughts will be more prevalent when deforestation happens - no question. We are also ruining some marginal soil ecology & top soil at rapid pace. Maybe hybrids can keep up with this trend, dunno. Sorry on getting into the weeds here. Long term- a lot of variables that could change the values of farm land. Does anyone on here care or worry about values 20-40 years from now? Probably not- self included. It’s likely still an extremely good long term investment - even if we saw hybrids change the game or even a human population that actually DECLINED. Then u get into development potential in Midwest (hate it but folks think about it)- if a guy wanted to think in those terms- especially strong long term in growing areas IMO.

Buy it if u can & can handle risk if/when it goes down. But be ready for a lot of dynamics & changes “no one saw coming” in the process. It’s likely a never ending CYCLE. Buy it, enjoy it and forget about the rest of the worlds issues if possible.

Buddy on here sent me this article today.

I wanted to highlight ONE part. Food for thought on some long term thinking. Land probably is better or best asset in response to this - in short. Perhaps - or where I’d personally feel best.

This data is crazy & at least makes me wonder all the dynamics ahead.

Not to worry about …. as we can’t control it… sure a big dynamic to think about though …

I wanted to highlight ONE part. Food for thought on some long term thinking. Land probably is better or best asset in response to this - in short. Perhaps - or where I’d personally feel best.

This data is crazy & at least makes me wonder all the dynamics ahead.

Not to worry about …. as we can’t control it… sure a big dynamic to think about though …

I got real pissed when rates dropped below 3% after jumped on 3.3% refi. Now I'm feeling pretty OK about it! ha

Sent from my iPhone using Tapatalk

letemgrow

PMA Member

I got real pissed when rates dropped below 3% after jumped on 3.3% refi. Now I'm feeling pretty OK about it! ha

I got lucky and hit the low or close to the low. 2.86

Sent from my iPhone using Tapatalk

Nrharris

PMA Member

I did mine 15 years at 2.6. Missed 2.5 by a couple weeks. Glad I got it done when I did.I got lucky and hit the low or close to the low. 2.86

Sent from my iPhone using Tapatalk

Mine has been at 2.75% since 2012. Five years to go and will be fully paid before the first kid hits collegeI got lucky and hit the low or close to the low. 2.86

Sent from my iPhone using Tapatalk

sep0667

Land of the Whitetail

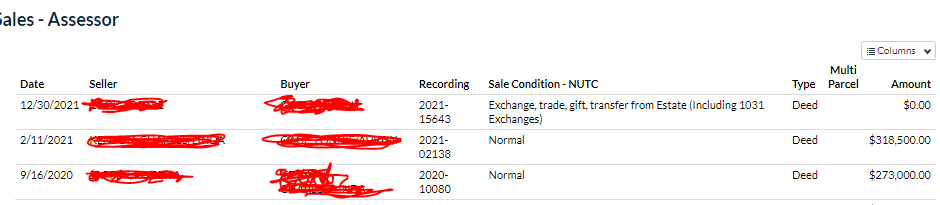

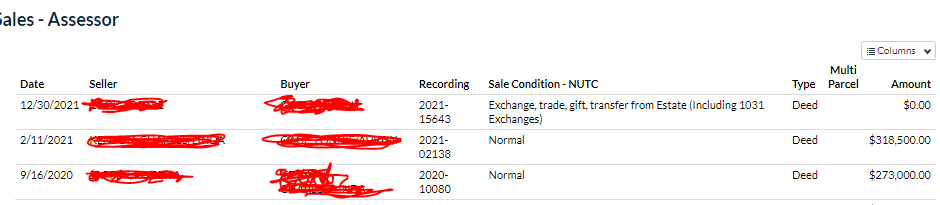

Here is an example of a piece that is up for sale right now. This literally just sold a little over a year ago in winter of 2021 and prior to that in September of 2020. In 19 months the asking price has gone up in price by $386,750, more than double what it just sold for in September of 2020. This is mindblowing!!!! Madness!!!! A pole barn and some blinds were just added to it, but still.....

And I bet you it sales at this asking price!!

Reason I have noticed this one is because last winter when it was for sale and I saw the listing I was really interested in it, I even messaged the prior owner about it. But, I felt the asking price was a little to high. I'm kicking myself a little now as what I bought was more $, is a little smaller, and twice the distance from home as this. Live and learn I guess.

www.landandfarm.com

www.landandfarm.com

Its public record, but out of respect I blurred names.

And I bet you it sales at this asking price!!

Reason I have noticed this one is because last winter when it was for sale and I saw the listing I was really interested in it, I even messaged the prior owner about it. But, I felt the asking price was a little to high. I'm kicking myself a little now as what I bought was more $, is a little smaller, and twice the distance from home as this. Live and learn I guess.

91 acres, Lacona, IA, Property ID: 16335626 | Land and Farm

91 Acres in Warren County, 91 acres in Lacona, Iowa offered at $591,500. View 21 photos, read details, and contact the seller.

Its public record, but out of respect I blurred names.

Pole barn is worth as much as gold right now! haha

Hardwood11

It is going to be a good fall!

We are close to peak !!

sep0667

Land of the Whitetail

I could see someone getting themselves upside real quick on the piece above if there is a correction!We are close to peak !!

sep0667

Land of the Whitetail

Pole barn is worth as much as gold right now! haha

No doubt, put a little pole barn on it and its automatically worth another 150k lol

Wi transplant

PMA Member

Just my 2 cents but i drive all over se iowa everyday for work and in last week started to few a lot more vehicles up for sale buy owners ! High gas prices and interest rates will take its toll on land sales! Just looked today and 30 yr fixed is 5.98 and 15 was 5.56!!!! Breaks go on soon!!!!!

Sent from my SM-G996U using Tapatalk

Sent from my SM-G996U using Tapatalk

hesseu

Well-Known Member

Regular people purchase based on what they can afford per month. Corporations are a different animal...

Inflation is outpacing what the media is reporting. With what I do for a living, I feel I have a pretty good pulse on 3,6, 12 months from now. I told my wife back in February to start stocking up on dry goods because when May gets here, we'll be paying twice as much. And, you'll need to get it while it's in stock if you want it. Sadly, her and I spoke a few days ago and I said to her in the next 12-24 months I'm afraid we will be hearing and seeing about a lot of BK's. Obviously it will be more pronounced in metro areas (which we are no where near!).

2-3 weeks ago put a full price offer down on a parcel. I was first to it, and they turned into a bidding war. I was not going down that road. As much as I'd love to add more land, I am in no hurry if it isn't a wise business decision.

Inflation is outpacing what the media is reporting. With what I do for a living, I feel I have a pretty good pulse on 3,6, 12 months from now. I told my wife back in February to start stocking up on dry goods because when May gets here, we'll be paying twice as much. And, you'll need to get it while it's in stock if you want it. Sadly, her and I spoke a few days ago and I said to her in the next 12-24 months I'm afraid we will be hearing and seeing about a lot of BK's. Obviously it will be more pronounced in metro areas (which we are no where near!).

2-3 weeks ago put a full price offer down on a parcel. I was first to it, and they turned into a bidding war. I was not going down that road. As much as I'd love to add more land, I am in no hurry if it isn't a wise business decision.

Hardwood11

It is going to be a good fall!

It is not just the rise in interest rates, if the markets go backwards that hurts the net worth aspect. You can factor in that property taxes will go up now as well. In some cases it will be a big jump. That could trigger some people to sell.

Last edited:

tall@wide

PMA Member

I'm glad I own a great farm now. There is no way I would buy a farm right now unless I found a deal thru a private landowner. Looking at the websites that sell land, it is almost comical what they are asking for farms right now. I have seen some farms sell recently that went way too high near mine, and they are being bought by very wealthy individuals who need to buy something on a 1031 exchange.

hesseu

Well-Known Member

I'm glad I own a great farm now. There is no way I would buy a farm right now unless I found a deal thru a private landowner. Looking at the websites that sell land, it is almost comical what they are asking for farms right now. I have seen some farms sell recently that went way too high near mine, and they are being bought by very wealthy individuals who need to buy something on a 1031 exchange.

Very true in regards to the 1031 exchanges. I'd be looking for long term hold on property right now just in case