I think you'll have a stiff recession here shortly and circumstances will change.

I'm no economics expert, but I did watch a video AND stayed at a Holiday Inn Express last night....so, darn near an expert.

Kidding, just want to pick your brain a bit....

I don't see a recession coming for a few reasons.

Yes, the fed has increased interest rates a quarter of a percent, and is threatening to do that 6 times this year. This is an effort slow the economy a bit and to reel in inflation. I say big whoop. Inflation is running what....8-9%....but that's only for people who don't use food and fuel....but I digress.

So if inflation is at 9ish%, and lending is only around 4.5%, what's to slow the economy? Folks will just keep borrowing and buying because it's going to cost more tomorrow.

I also see the fed's actions as a bit of a window dressing. If they were to raise interest rates to match inflation, it would instantly cost close to a trillion a year just to service the national debt. (interest only!) Can't do that.

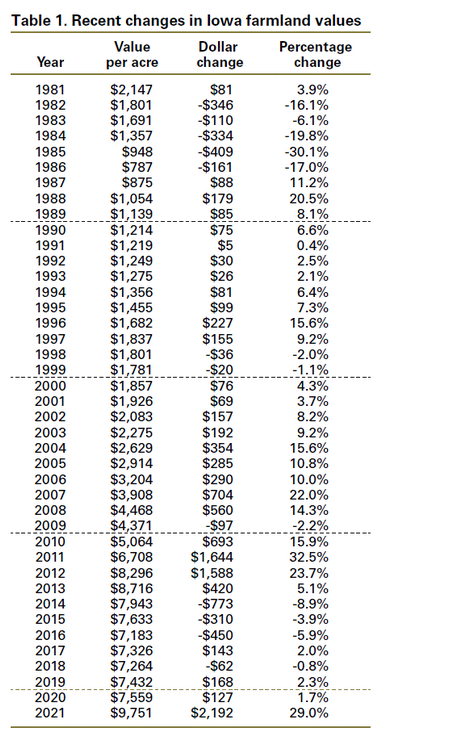

Given Ukraine's corn may not exist, Russian wheat unavailable, China's wheat crop terrible, and massively high cost and shortages of fertilizer, only direction food prices are going is up. When grain is high, land is high.

Add supply chain problems and high fuel prices, with no relief in sight due to Biden's refusal to drill, and you have a great formula for long term sustained inflation, along with high demand for goods and services.

Am I crazy? Your thoughts please!