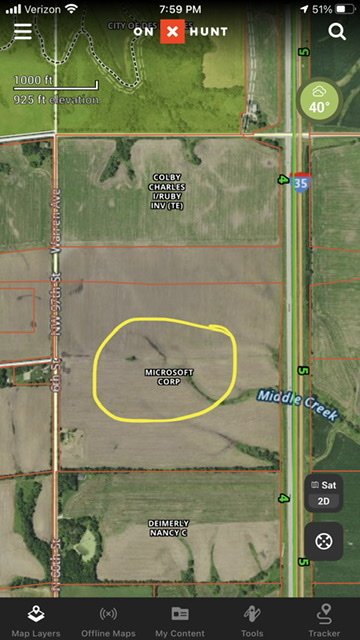

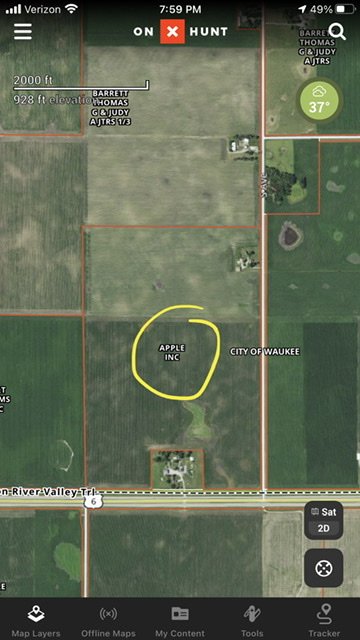

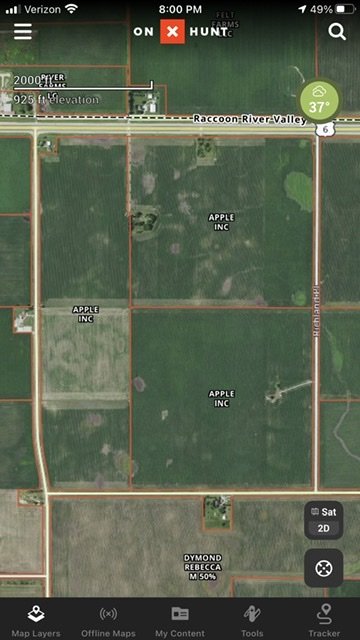

I am seeing more titling like this around me. For higher end ag ground. Clearly not for “hunting land”.

View attachment 122084View attachment 122085View attachment 122086

No doubt the out of state investments have been ramping up tillable ground much harder in last 12-18 months. There’s a limited supply of high end dirt …. When inflation hits, other investments aren’t ideal…. Many look to higher end tillable as a “safe bet”. Are they paying “too much” ? Sure. Does it matter to them? NOPE. Even if values cut in half- they don’t care. A lot of investment $ has hit the Midwest ag market…. A lot of other “big names” that put it in an LLC, Corp, trust, etc where u don’t realize who it is. It doesn’t mean these prices will stay high or these folks won’t lose on shorter term values BUT it does speak to the uniqueness & likely, safety, of long term investing in high end ag ground.

On other hand…. The “counter argument” to high end ag ground…. 1) With hybrids making leaps & bounds by the decade- we can grow more on marginal ground. Possibly increasing supply to the point where it puts down pressure on high end ag land prices. 2) “they aren’t making any more of it” - is not quite true unfortunately…. As humans doze out countless thousands or millions of acres of places like Brazilian rain forest- we are rapidly expanding the agricultural areas. Even the dozing you see in the Midwest when grain spikes- astounding. There will be some problems from it…. Droughts will be more prevalent when deforestation happens - no question. We are also ruining some marginal soil ecology & top soil at rapid pace. Maybe hybrids can keep up with this trend, dunno. Sorry on getting into the weeds here

. Long term- a lot of variables that could change the values of farm land. Does anyone on here care or worry about values 20-40 years from now? Probably not- self included. It’s likely still an extremely good long term investment - even if we saw hybrids change the game or even a human population that actually DECLINED. Then u get into development potential in Midwest (hate it but folks think about it)- if a guy wanted to think in those terms- especially strong long term in growing areas IMO.

Buy it if u can & can handle risk if/when it goes down. But be ready for a lot of dynamics & changes “no one saw coming” in the process. It’s likely a never ending CYCLE. Buy it, enjoy it and forget about the rest of the worlds issues if possible

.